If you're able to’t spend your payday loan off in complete on the requested date, you’ll have to roll your loan over, that means you’ll be responsible for the principal stability and additional charges and curiosity. As well as, there’s the significant risk of default that may cause credit history damage and wage garnishment if a lender sues you.

Use this calculator to view your prospective payday loan APR. Payday loans can set your finances at risk, so it’s a smart idea to Evaluate alternate options.

Lenders layout payday loans to produce consumers reliant on them since the loan repayment due day is rather

And if the loans are rolled-around further than the Original repayment day, it incurs a lot more service fees and curiosity. Which is why it's essential to utilize the payday loan calculator before taking out any of this sort of loans.

Borrowers normally opt for payday loans since they don’t require a least credit score score. If you're able to prove you’re employed and getting an everyday paycheck, your odds of acceptance are very high. In truth, a lot of payday lenders publicize payday loans as no-credit history-check loans, which means your credit history score and historical past aren’t thought of whatsoever.

And those with little if any cost savings to cover an emergency are more likely to decide on payday loans within the absence of the crisis financial savings account.

In case you depend on payday loans, you should have fewer income to deal with regular essentials. At worst, you can even tumble powering with your regular paycheck.

Payday lenders don’t demand a traditional curiosity amount on their loans and also you don’t create a regular monthly payment. You must pay the entire quantity borrowed as well as no matter what payday loan fee they cost when you receive your subsequent paycheck. This can be a shock for shoppers made use of to making least payments on credit cards, or spreading payments out more than various years such as you can with a vehicle or personal loan. Payday loans can usually be acquired at a local lender or credit history union or by implementing online. They’re controlled at both equally the federal and condition degree. However, many states have regulations that Restrict the costs or curiosity fees payday lenders can cost, and Other folks have banned payday loans completely. The amount of do payday loans Expense?

Depending upon the direct lender and also your point out of residency, you are able to submit an application for a Payday Loan on the internet or in-retail store. Use our retailer locator to view whether or not Payday Loans are available in your location.

Our monetary options are made for borrowers with every type of credit histories. We base our acceptance conclusion on things further than your credit rating rating, for example your employment position, debts, and payment record.

One example is, they're able to let you do your laundry at their area, saving your prices with the laundromat, or they are able to make dinner along with you and provides you leftovers that can final until payday.

After a borrower challenges a bond, its worth will fluctuate dependant on curiosity premiums, industry forces, and all kinds of other factors. Whilst this does not change the bond's worth at maturity, a bond's industry value can however change in the course of its life span.

Even so, payday loans are deemed predatory loans. Lots of borrowers who are not able to repay the high-curiosity level and fees and more info however meet their every day dwelling expenditures turn out defaulting.

Borrowing out of your employer need to be the next resort. If you may get an progress on your own paycheck to form out an emergency, it is best to ask for it.

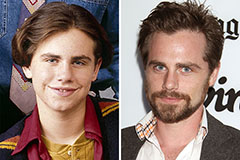

Rider Strong Then & Now!

Rider Strong Then & Now! Spencer Elden Then & Now!

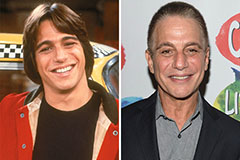

Spencer Elden Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Brandy Then & Now!

Brandy Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!